Warren Buffett

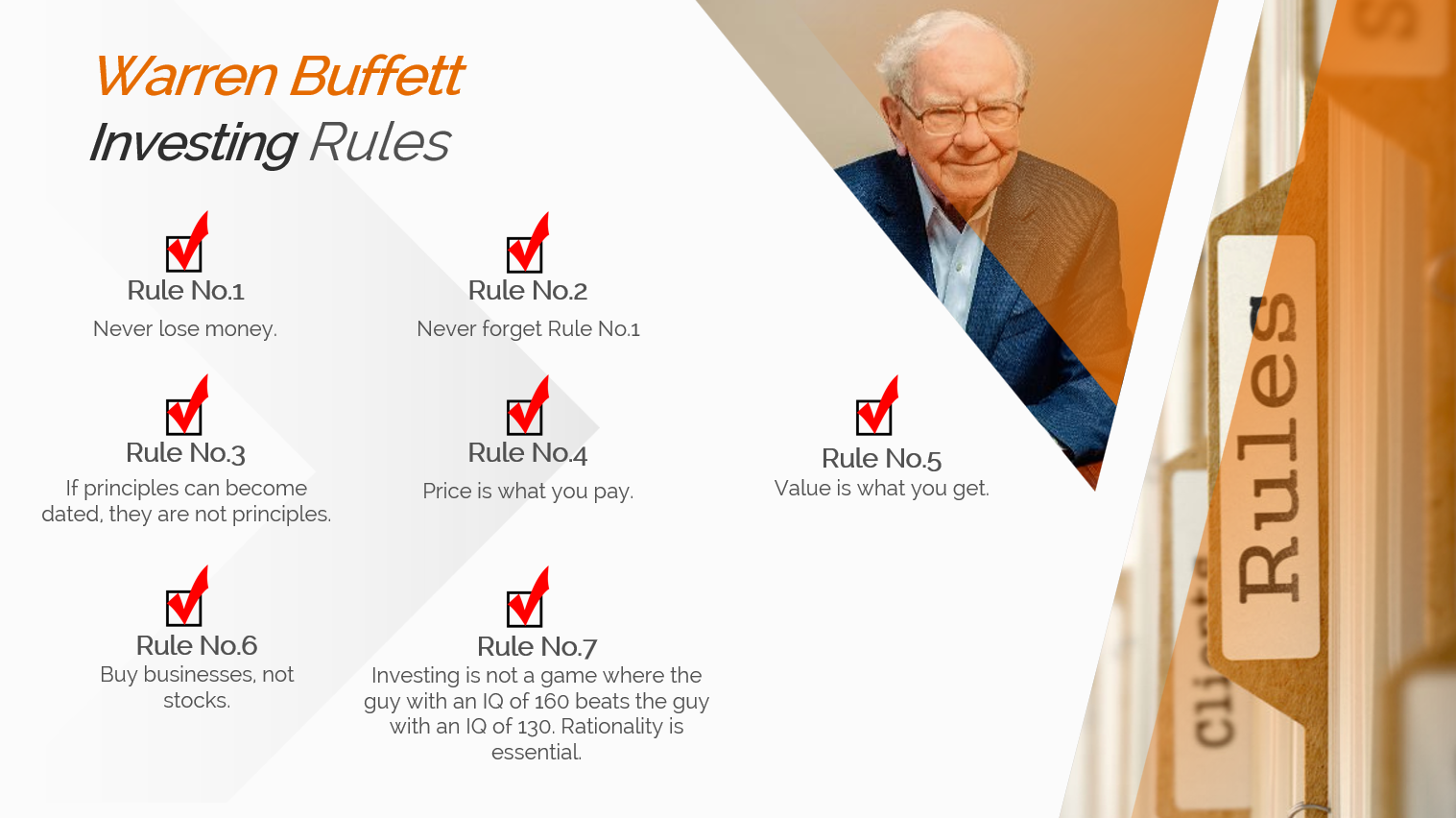

Warren Buffett is considered one of the best investors of all time. He is referred to as the “Wizard” or “Oracle.” The Wizard has seven “Investing Rules” for stocks. We apply the same rules to our real estate investing.

Warren Buffett is considered one of the best investors of all time. He is referred to as the “Wizard” or “Oracle.” The Wizard has seven “Investing Rules” for stocks. We apply the same rules to our real estate investing.

As we have explained above, Warren Buffett’s Investing Rules applies to real estate market just as well as the stock market. Even more so than the stock market. That is why Mr. Buffett is undoubtedly interested in investing in cash flow properties as well as the most prominent private money hedge fund company, Black Stone, is actively investing in real estate as well. Our unique investment approach will guide us to a safe yet very lucrative opportunity.